A big-ticket reform that will transform the entire gamut of Indian business scenario is finally taking shape. Goods and Service Tax bill or GST bill as it is popularly known as, after getting elder house’s absolute nod will soon see the day with the passage of the bill from Loksabha. Though it needs to be vetted by at least 15 state legislatures but owing to the consensus between almost all political parties of the country, it’s passage seems to be a matter of time.

The question now arises as to how implementing GST will benefit Real Estate Sector. A short synopsis given below will help understand the benefits to the Real Estate Sector from the implication of GST.

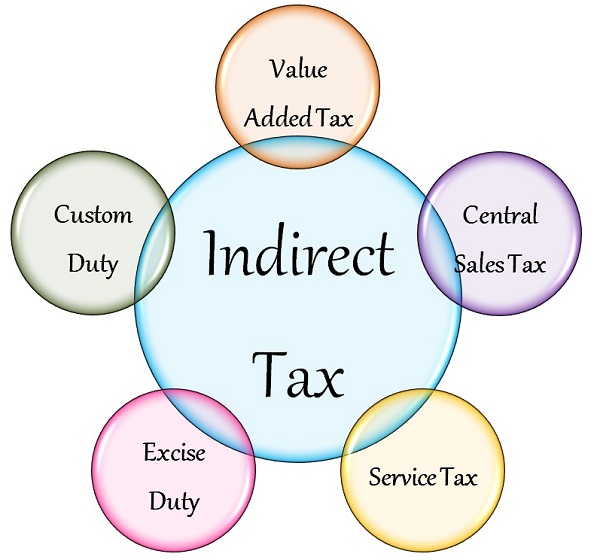

The Goods and Services Tax is expected to be implemented from April 1, 2017.The Goods and Services Tax (GST), is a comprehensive indirect tax on the sale, manufacture and consumption of different kinds of goods and services throughout India, with all other central and state taxes intended to be subsumed under it. This tax will have far-reaching implications, including on real estate.

Existing taxation norms

The real estate industry in India has witnessed major tax changes, in the last few years. However, these taxes are not uniform all over the country – different practices and regulations are followed in different states. It was the 46th amendment to the constitution that brought massive changes towards taxation in the real estate sector. Subsequently, special powers were given to the state governments, for implementing Value-Added Tax (VAT) on some specific kinds of transactions.

For land, property and other kinds of work contracts, the state government and the central government levy different kinds of taxes. The transactions are mainly categorized in three parts – value of services, value of goods and materials, and value of land. The state government on the goods portion applies VAT, while the value of services is taxed by the central government. However, other than stamp duty, there is no clear tax on the transactions regarding the value of land. This situation leads to confusion and can result in dual taxation. Compliance and implementation of such taxes are also difficult.

This has led to a situation, where for one real estate transaction, multiple taxes need to be paid. This has a negative effect on the industry.

The industry’s demand to bring GST on board is primarily to get a clear and transparent taxation rule for the real estate sector in India.

Impact of GST on Indian realty

The implementation of GST can prove to be a significant step in reforming indirect taxation in India. Chances of double taxation would be diminished, as some of the central and state government taxes will be amalgamated into one tax. This will ease the process of taxation considerably, making it easier to enforce and administer.In the current situation, a developer incurs various kinds of expenses during the construction phase of a project. Different kinds of taxes are involved with these expenses, such as VAT/CST, customs duties, service tax, excise duty, etc. A majority of these taxes are expenses that are included in the system. This is because they are not creditable to the developer or to the end-customer. These non-creditable expenses lead to tax inefficiency, which is not desirable.

One positive impact of the GST could be the doing away of restrictions on credit utilization. This will definitely help in strengthening the credit chain in the entire system. If builders can properly manage this aspect, they will see some profit.

The proposed GST structure should provide a progressive and streamlined approach. Presently, builders running projects in different states have to comply with state-specific VAT laws, as well as other kinds of service taxes. Bringing in GST will, therefore, not bring any additional compliance burden on real estate builders in the country.

Issues regarding GST, which affect real estate builders

Developers, on their part, have also been seeking certain clarifications, vis-à-vis GST. For example, the definition of a real estate developer varies from one state to another. The composition scheme varies according to state, in which the VAT rates range between 1% and 5%. In some states, there are differences between the terms ‘real estate contractors’ and ‘real estate developers’. These different meanings will have to be factored in while evaluating the GST implications.

There might be some confusion regarding GST implementations on residential property, as well. In the present scenario, there is no service tax applicable on renting immovable property, particularly for residential purposes. However, service tax and VAT is applicable on construction work. The question that arises is if the GST will offer differential tax for residential properties.

As of now, it does not look like completed residential projects will be affected by GST, as buyers into completed projects have already paid the statutory charges, such as stamp duty and registration charges on the transaction.

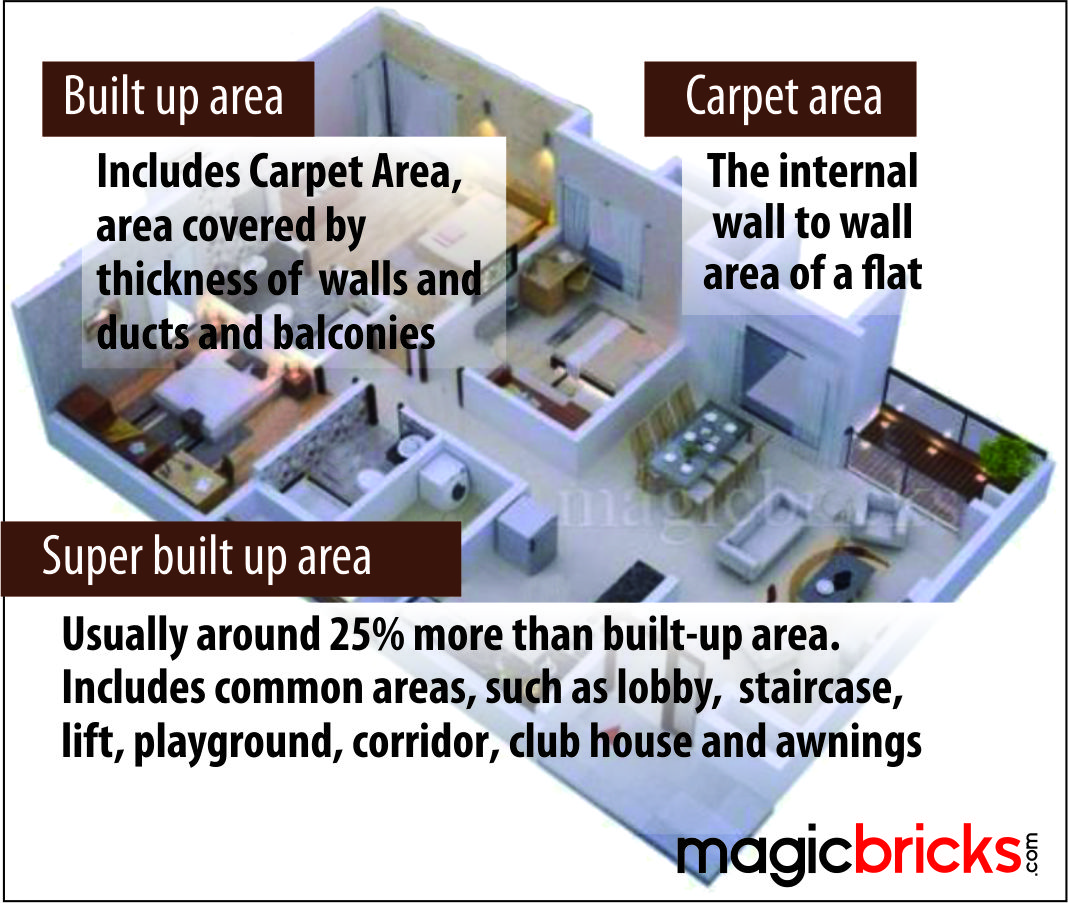

The segments to watch on the GST front are under-construction flats and rental flats, which are expected to come under its ambit. GST will apply to the materials that a developer procures for building a residential project. Hence it will have a direct impact on the overall cost of construction.

Moreover, a lot also depends on the final rate of GST. If it is more than the existing cumulative taxes, then, the overall cost of buying an under-construction flat will increase, along with the added cost of stamp duty and registration. Developers will also have to keep an eye on costing, as price competitiveness is very important in the current real estate market scenario.