If you are about to buy a new home or an apartment, there are several Vastu aspects of the property that you must check. Here’s a quick guide

The Indian architectural science of Vastu Shastra has been a basis for identifying and developing the best living spaces. Vastu-compliant plots and homes, help the inhabitants to live their lives with more happiness, wealth, health and prosperity. This ancient practice has gained popularity in the real estate space, for identifying the best places, plots and structures for residential, as well as commercial purposes.

Vastu compliant entrance

While evaluating the design plan or layout of a plot or a construction (flat or apartment), the first consideration should always be for a good entrance. The entrance holds the key to ushering in positivity and happiness for the entire family.

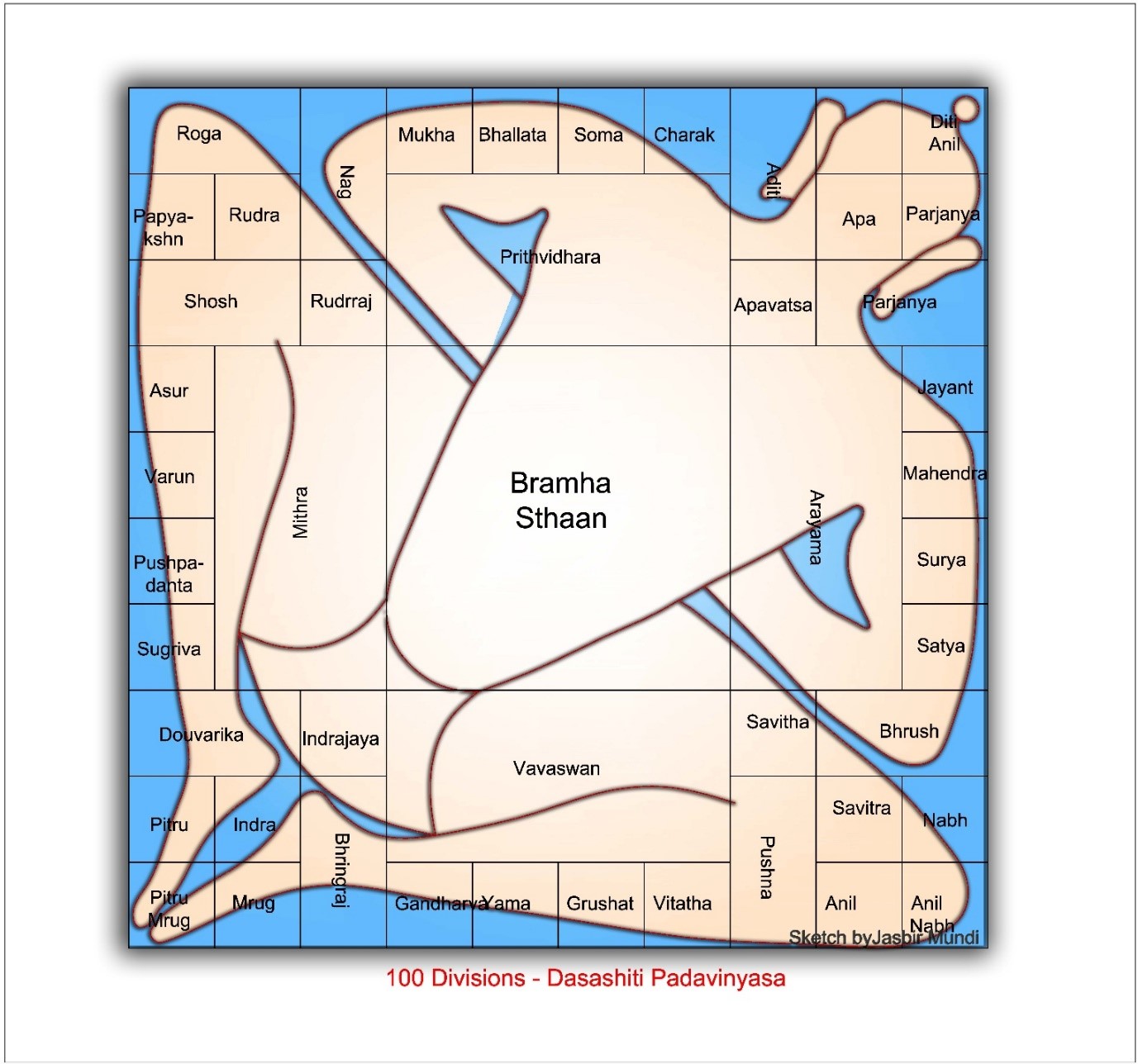

Each living space has 32 possible locations that can function as an entrance of a building. Each of these 32 locations has their own significance and affects our lives accordingly. For instance, an entrance in the southeast zone, the Vastu zone of cash, results in delayed payments. A southwest entrance is among the least Vastu-compliant entrances and families living in such homes can face monetary and relationship issues to a great extent.

On the contrary, if you have an entrance in the north, you can expect great success in monetary and business matters, as well as opportunities in your career. If your chosen property or apartment does not have a Vastu-compliant entrance, you can still buy the property and apply certain simple Vastu remedies.

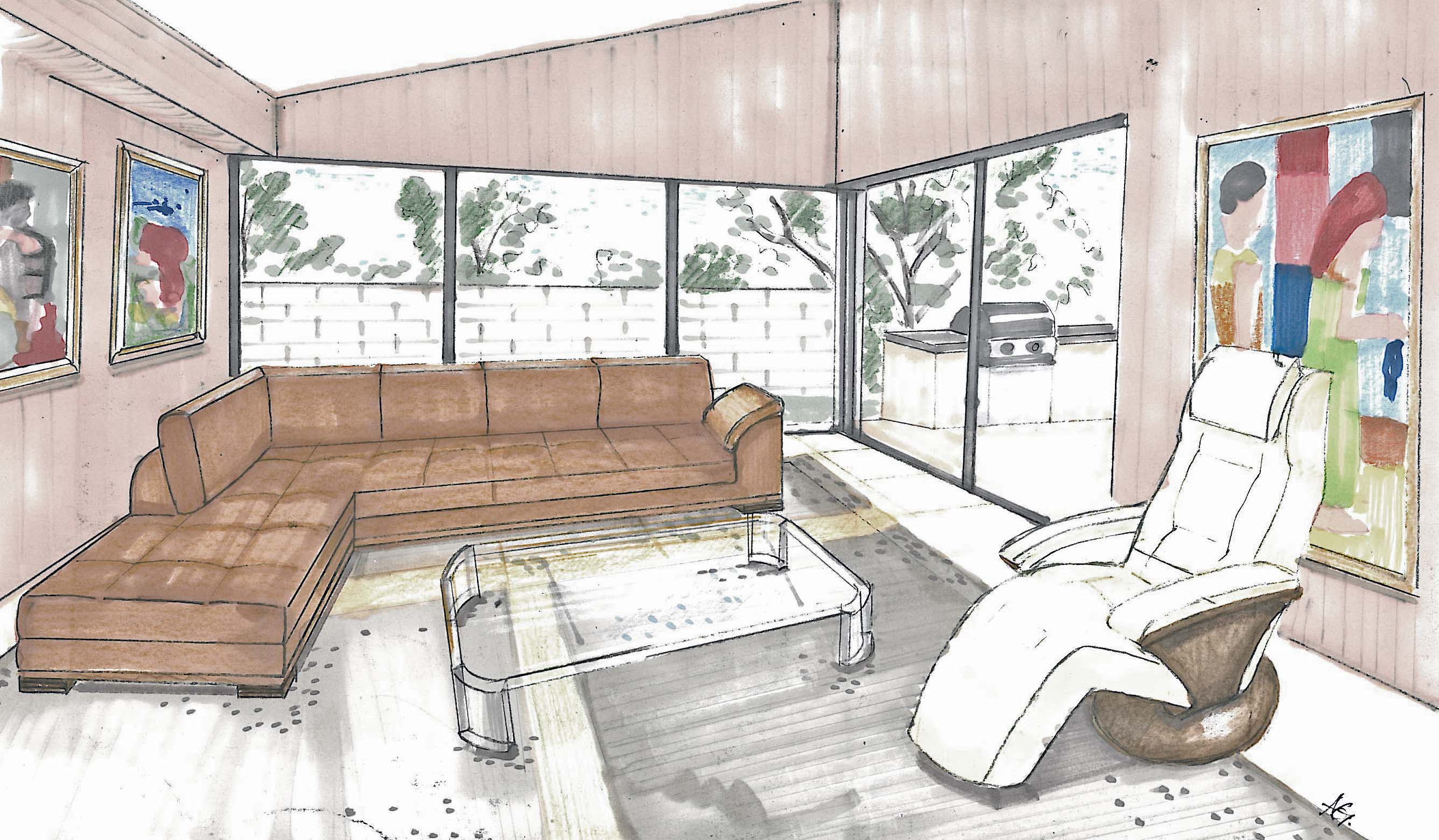

Vastu compliant room direction

The correct location for a room ensures that you benefit the most from that room. Each room has a positive or negative effect, on the lives of inhabitants of the house, depending on the zone in which it is located.

For instance, a living room in the east zone is ideal for developing and strengthening social connections. On the other hand, a bedroom between the east and southeast should be avoided as per Vastu. Sleeping in these zones results in increased anxiety and disagreements with one’s spouse.

One should avoid building a toilet between the north and the northeast zones in the house. It can severely affect the immunity and health of the members of the family living in the house. For kitchens, the southeast is an ideal zone. One should avoid having a kitchen in the northeast and southwest zones.

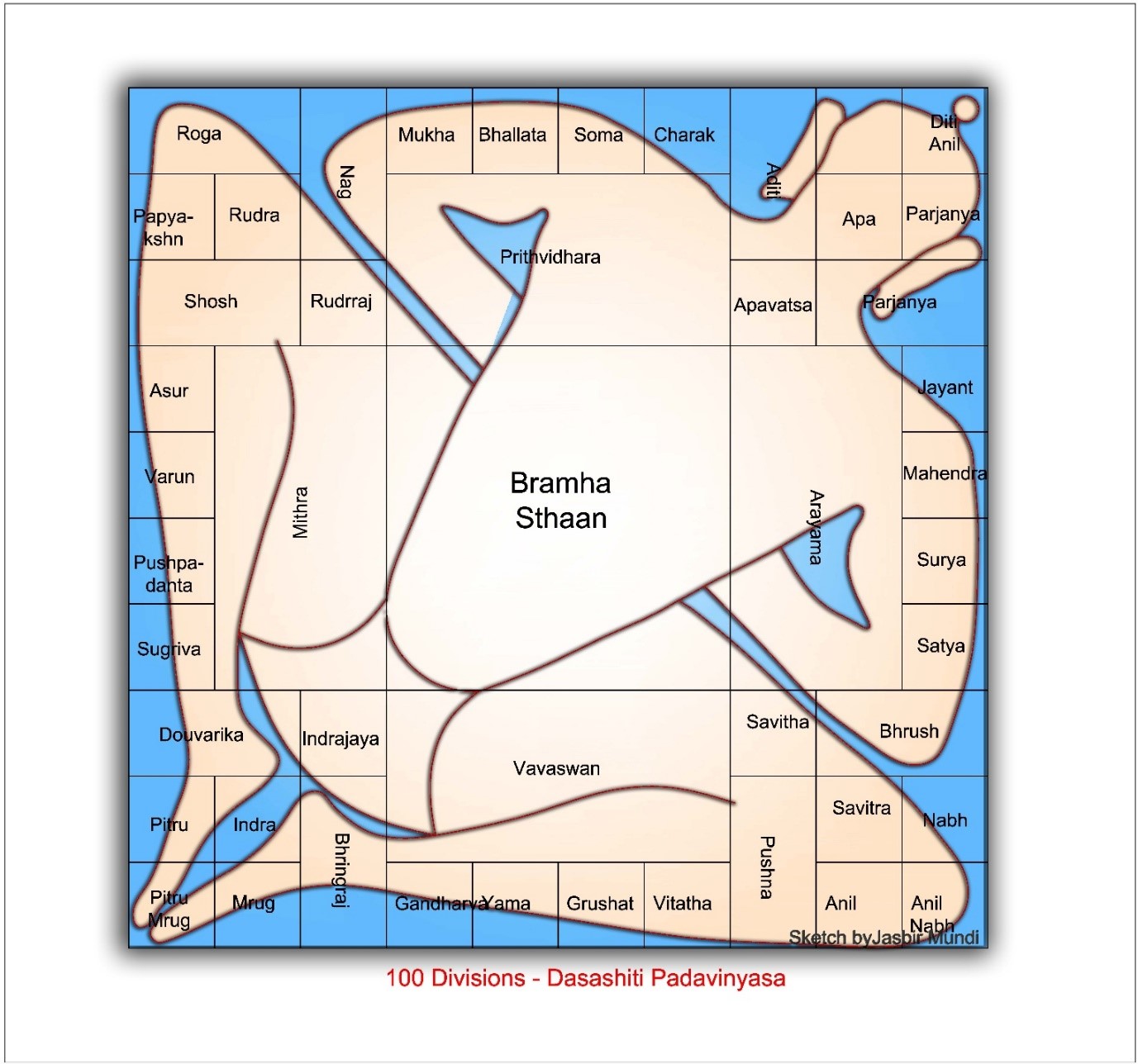

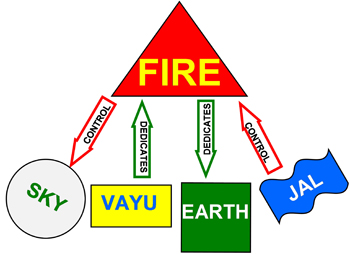

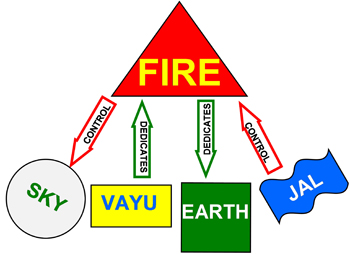

Panchtattava or the analysis of the five elements

A living space is divided into 16 zones or directions in space. Each zone has a corresponding main element that affects different aspects of our life. For example, the north zone has water as the main element. The main attributes of this zone are wealth, growth, career, monetary gains, etc. Consequently, any imbalance in this zone has a direct impact on the career, business and monetary health of the inhabitants.

Similarly, fire is the main element of the south zone. The main attributes of the south zone are sleep and relaxation.

While purchasing a home, one needs to check the location of different rooms and internal elements that make up the home. These include kitchen, toilets, balcony, slopes, open areas, water tanks, gardens, service lanes, water storage of neighbors, rainwater drainage, the building’s height, shafts, etc. It is important to verify that each of the 5 elements or Panchtattava, is present in its respective zone – water in the north, the air in the east, fire in the south, earth in the southwest and space in the west.

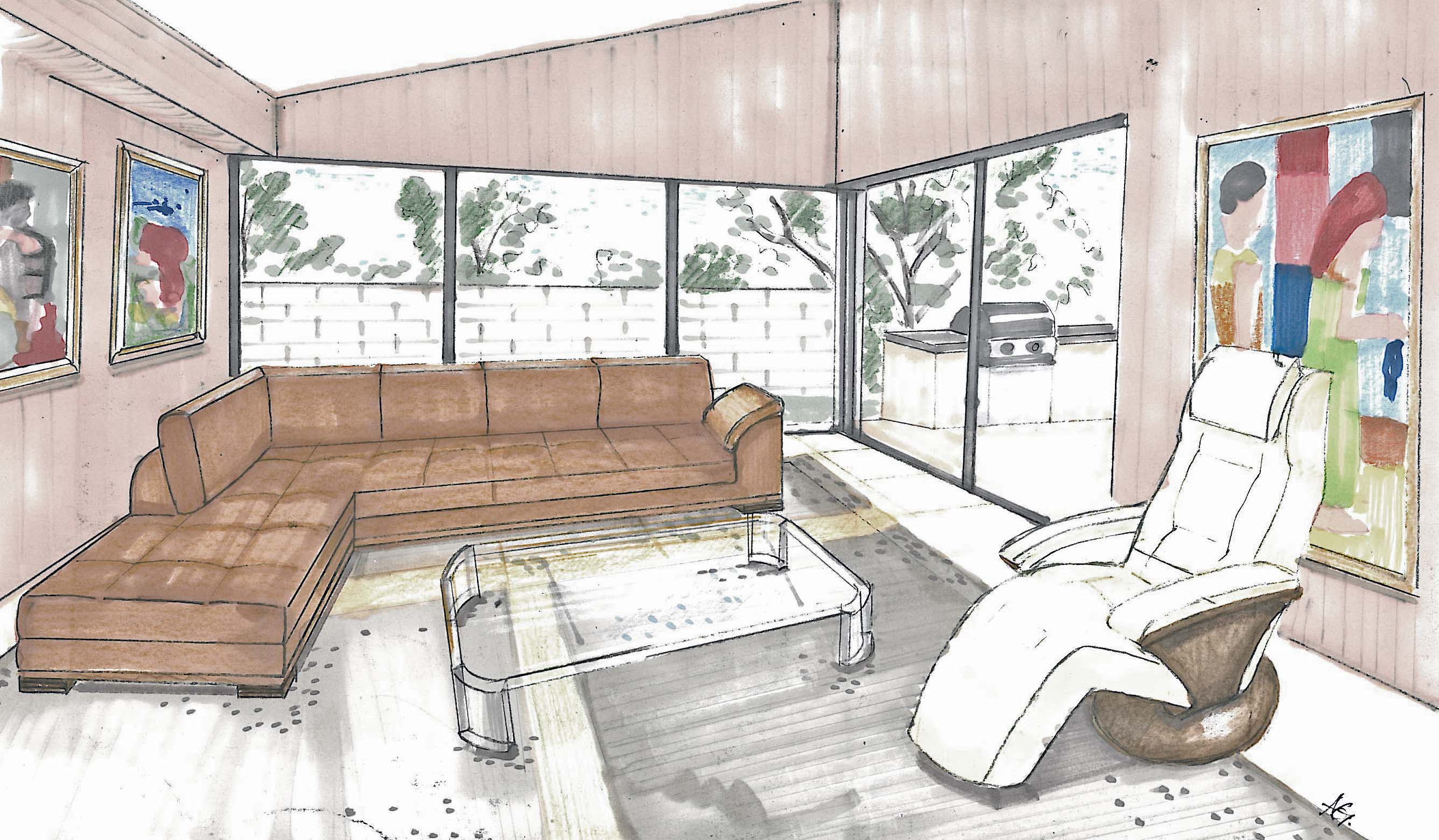

Modern Vastu and space programming

What if you have already purchased a property or paid the booking amount? In such cases, you can use the fourth check of Vastu – space programming. With modern Vastu applications and techniques, you do not need to deconstruct or demolish your property. Through simple and effective Vastu techniques and remedies, you can balance the elements in a particular zone. The use of colors, shapes, lights, metals and symbols, are highly effective in this regard.