While the government may feel the need to offer incentives to home buyers in the union budget 2017-18, to boost its objective of ‘Housing for All by 2022’, the present state of the economy may restrict good news for home buyers. An analysis.

The state of the Indian economy, suggests that the government will have to walk a tightrope with the Union Budget 2017-18, amidst forecasts of a slowing economy. Although banks are now flush with funds, due to the government’s demonetization drive and limit on the extent of cash withdrawal, the overall effect of the measure has not gone down well, with the health of the economy.

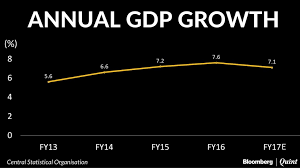

The Indian Central Statistics Office has estimated that economic growth will slow to 7.1% in the current fiscal year ending March 31, 2017. This is slower than the government’s prior estimates and the 7.6% growth, last year. The estimates have been reduced in all the sectors, except agriculture, which has improved due to the positive monsoon season. Analysts, however, warn that these forecasts are toned down since the real impact will be seen in the upcoming fiscal year.

Moreover, the impact on agriculture will also be visible, as the demonetization immediately prior to the crop season will take its toll.

Similarities with global markets brings hope to Indian realty

The real estate fraternity, nevertheless, remains upbeat and believes that the state of the economy, definitely allows the government to provide relief to the real estate sector and homebuyers.

They cite the Morgan Stanley report dated December 6, 2016, which suggests that annual Indian property sales are expected to grow, from USD 105 billion in 2015 to USD 462 billion in 2025. Research estimates a 14% compound annual growth rate (CAGR) for property sector demand during 2015-20 (8% volume, 6% pricing) and an 18% CAGR in the five years after that, versus the 12% CAGR (5% volume, 7% price) over the past six years.

India in 2015 is also similar to China in 2000-03 on key macro parameters. In the past 15 years, China’s economy and per capita income have quadrupled, urbanization has doubled and the property segment has grown 10x, to USD 1.3 trillion in annual sales.

Why real estate cannot be generalized with other sectors

“While the slow job market is a challenge, on a macro level, a one-size-fits-all statement cannot be made about the economic situation. This is because, while the cash-driven markets like Delhi-NCR are witnessing a slowdown, the service-driven markets are not that much affected,” is the view of experts.

The demonetization drive has resulted in increasing the expectations of the common man, vis-à-vis the upcoming budget. The realty sector will be benefited indirectly by an exemption in tax rates, as it will increase buyers’ purchasing power. The budget should provide a holistic model, where developers are incentivized for budget housing.

The budget should cover the entire value chain for the delivery of the affordable housing – from procurement of materials, government premiums and quicker approvals to developers, to stamp duty payments and lower home loan rates.

Impact of previous policy changes

Experts point out that the government offered various incentives to businesses in the previous two budget sessions. 2016 witnessed a strong foundation being laid for the real estate sector, with policies like Smart Cities, Housing for All by 2022, the Goods and Services Tax (GST), implementation of the Real Estate Act, demonetization and Benami Transaction Act. Consequently, the upcoming budget will be a step further in the right direction. While the sum of the recent policy changes is expected to improve the sector’s practices, the state of the economy may leave little room for the finance minister to provide major sops and ensure that Indian real estate remains an end-user-driven market.

Challenges for the finance minister, vis-à-vis real estate and the budget

- The emerging economic and political compulsions suggest that the finance minister may unveil a budget that is friendly to middle-class home buyers.

- Rate cuts ahead of the budget may indicate more sops.

- However, the state of the economy leaves little room for any budget bonanza.

- Growth in real estate can help GDP growth but excess liquidity could also derail the economy with artificial growth.